The US property and casualty (P&C) insurance industry is experiencing a prolonged period of robust financial strength, with no clear end in sight. According to insurance research firm ALIRT, both commercial and personal lines are seeing record-high composite scores, indicating exceptional financial health.

“We see no reason why this current supercycle cannot continue well into 2025, if not beyond, ALIRT analysts highlighted in its recent US P&C Industry Review. “The industry is in a super defensive position – even as it continues to rake in profits,” they added.

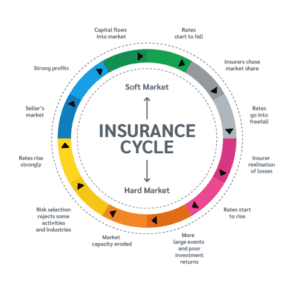

This “supercycle,” a term used to describe an extended period of strong market conditions, is driven by several factors. On the personal lines side, significant losses in recent years, particularly in auto and homeowners, have forced insurers to implement substantial rate increases.

This is coupled with a retreat from high-risk areas and stricter underwriting practices in response to escalating weather-related losses and inflationary pressures.

Analysts stated: “As regards the personal lines sector, the sizeable auto and homeowners losses in 2022 and 2023 were simply not sustainable.

A personal lines crisis loomed as homeowners insurers especially, facing mounting weather-related losses in what appears to be a new climate change-impacted era (coupled with a several-year spike in inflation and reinsurance market retrenchment), began to exit or seriously restrict exposures in ever wider swaths of the country.

“Those carriers that opted to stick it out increasingly demanded substantial rate increases which, in a growing number of jurisdictions, are now being granted. A similar dynamic has been occurring in personal auto, the industry’s largest line of business, with targeted underwriting initiatives combined with rate increases having their intended effect.”

Despite very profitable results for most key Commercial lines over the past several years, underwriting discipline remains solid.

As pricing momentum decreases in certain sectors of the casualty insurance market, such as cyber, professional liability, and excess liability, concerns regarding reserve deficiency and attendant loss creep have emerged from recent management commentary.

Recent reserve increases by major reinsurers like Swiss Re, driven by social inflation and adverse claims trends, underscore these concerns.

“This reinsurer is not alone,” analysts said. “In fact, in September, S&P Global commented that in its opinion US Casualty is the “elephant in the room” for the global reinsurance sector, citing the need over the past couple of years for numerous casualty (re)insurers to bolster reserves, especially in the general liability, excess casualty, profession indemnity and commercial auto lines. The most cited reason for the poor claims trends is ‘social inflation’.”

The report stated: “Just as (re)insurers have started to get their arms around property pricing dynamics, the casualty side of the U.S. P&C market is having to address its own challenges.” This has led to a renewed focus on underwriting vigilance and continued rate increases.

Meanwhile, industry profitability – especially for commercial lines business – remains very strong and surplus continues to accumulate. Despite substantial dividend payouts, the ALIRT 50 Company Composite has added $94 billion in capital since 2019, a 30% increase.

Adding back those dividends gives you over a 50% increase in surplus, which demonstrates insurer’s financial strength, ALIRT noted.

These factors suggest, analysts concluded, that the current hard market, characterized by rising premiums and stricter underwriting, is likely to persist.