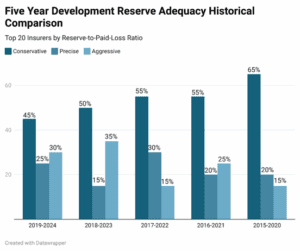

After five years of development that kicked off in 2019, only one in four of the top twenty insurers ranked by reserve-to-paid-loss ratio found itself in the sweet spot for actuarial accuracy-a ratio between 0.9 and 1.5-indicating that its assumptions and data-driven reserving were well tuned.

Although that share still counts as the smallest band, it marks a clear jump from the 15% seen in the 2018-2023 run. At the same time, the volume of both cautious and overly bold reserves has shrunk in tandem, rather like flapping sails being trimmed.

That swing probably owes much to fresh regulatory and accounting rules, chief among them IFRS 17 and newer NAIC directives. They discourage padding the balance sheet with excessive cushions-since that skews a firms true health-and they hit under-reserving hard, a practice that can shred solvency.

On top of that, leaps in data analytics, predictive modeling, and machine learning now give insurers near-real-time pictures of each open claim. Armed with that clarity, actuaries can set reserves more precisely and trim the safety margins that once padded their books.

Still, reinsurers and niche carriers that deal with long-tail lines tend to stay on the safe side, as the slow, volatile nature of those claims demands thicker cushions in any case.